By January 1, 2025, small businesses in the United States are required to report beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN).

A Beneficial Owner Information (BOI) Report filing is required for each affected business entity under the Corporate Transparency Act. Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company. Information needed to file includes your company name, address, EIN, ownership percentage, and photo ID.

The Corporate Transparency Act, passed by Congress in 2022, aims to uncover ill-gotten gains from shell companies and fraudulent ownership structures.

Congress hasn’t adequately informed the public about this law, and now that task is falling on accountants, lawyers, and compliance professionals.

Many business owners are not aware of this new federal requirement, putting them at risk of civil and criminal penalties.

Probably. If you operate a small business (fewer than 20 employees and less than $5m in revenue), you likely will need to file a report. All beneficial owners of USA-based LLCs that meet the requirements will be required to file. For more information about the companies exempt from filing, see our exemptions page.

There are three deadlines to be aware of. Depending on when your entity was created, you will fall under one of the deadlines below.

If the entity was already in existence on December 31, 2023, the report is due by January 1, 2025.

If the entity is created any time between January 1, 2024 through December 31, 2024, the report is due 90 days after it is created.

If the entity is created on or after January 1, 2025, the report is due 30 days after it is created.

Yes. Your FinCEN BOI filing is not a one-and-done thing. You now have a recurring obligation, courtesy of the federal government, to update your BOI filing within 30 days if any of the following occurs, forever:

For example, if you register a new business name or DBA, this will trigger a reporting requirement.

This includes a change to management or ownership percentage in excess of 25% for an individual.

If a beneficial owner's name, address, or unique identifying number provided to FinCEN changes.

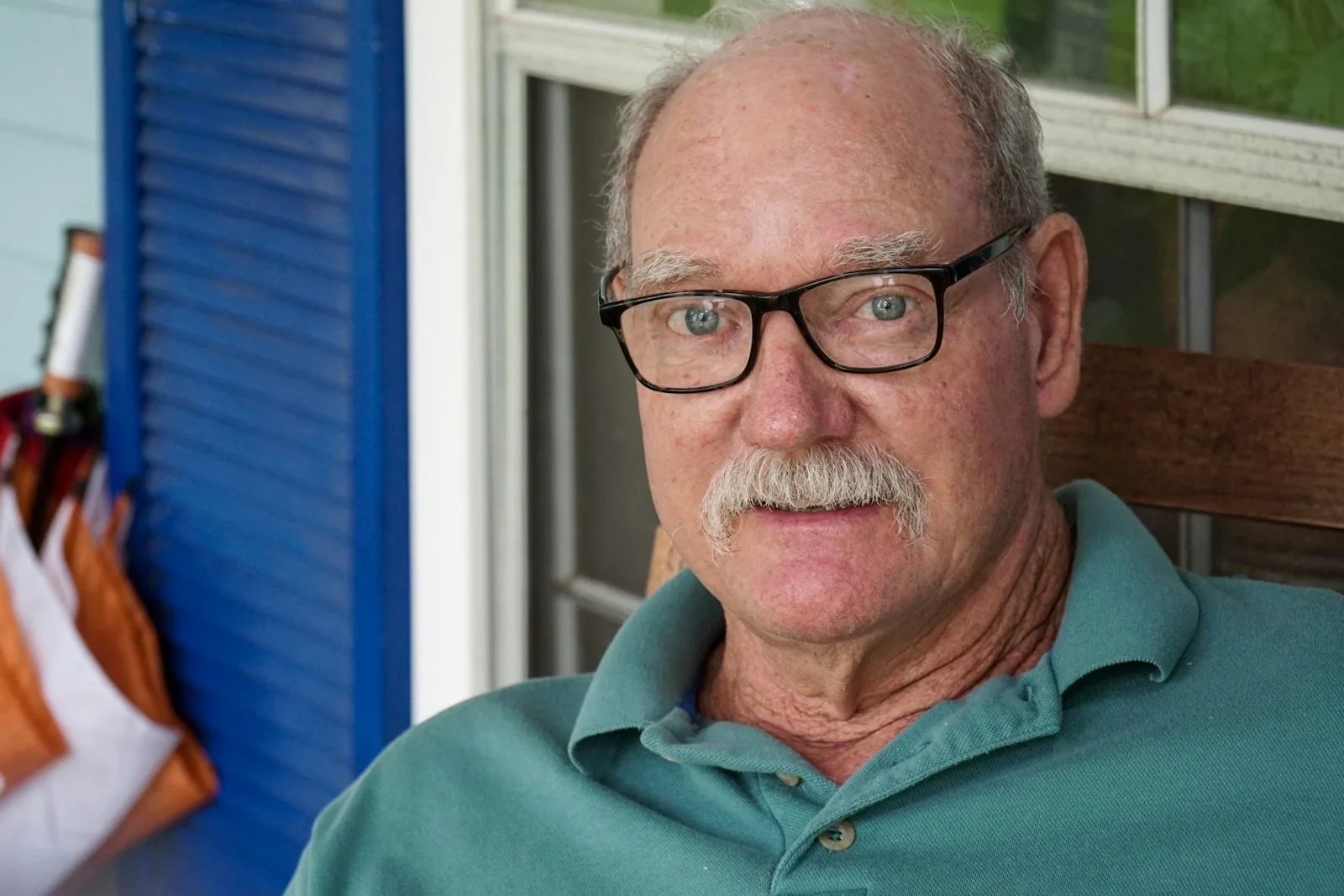

You need a simple, efficient, and comprehensive solution that ensures you’re protected. That’s why every filing is reviewed by a licensed, US-based business attorney.

Answer a few simple questions to see if you need to file a BOI report.

Once you choose your plan (by clicking “Get Started”) you will be directed to purchase your report.

Once your payment has been made you will be prompted to create your account. Once your account is created you will receive an email from us with a link to create a password and log into your account.

Our easy-to-use software will guide you through each question to accurately file your BOI report. Once your report is filled out completely you will be prompted to “Submit to firm”.

Once you submit your report to us you will receive a confirmation email. Our team of professionals will then review your information for accuracy.

Once our team has completed reviewing your report for accuracy we will e-file your report to FinCEN. Once we have successfully submitted your personalized report to the FinCEN, we will provide you with confirmation via email.

Yes. When your report is ready to be filed to FinCEN, a business attorney will review your report. The attorney will check for things such as entity type, formation, number of owners, structure, domicile, and other relevant factors. If there is a problem with your report, the attorney will provide an explanation and provide suggested changes. However, it is important to note that the Basic and Premium plans do not create an attorney-client relationship and are not legal advice. If you are seeking an attorney-client relationship, we offer the Elite plan which offers a 1:1 working relationship with an attorney during the filing process. In the Elite plan, an attorney will draft, prepare, and file your BOI report and provide you legal advice.

It depends on how quickly you can gather the necessary information needed to file the report. Some cases can be resolved in a matter of days, others take weeks or months. We will strive to submit your BOI filing as soon as practicable. Given the large volume of filings this year, we suggest you begin the process early to avoid any delays.

We recommend the subscription service to businesses without a comprehensive BOI compliance policy. It’s a service offering designed to simplify the management of your business by including (1) unlimited periodic BOI auditing, (2) unlimited BOI report filing changes, (3) and unlimited access to our team of compliance specialists. Many business owners choose the subscription to “set it and forget it,” allowing them the peace of mind to focus on managing their business under the watchful eye of a caring and dedicated BOI compliance partner.

The process is simple. First, we’ll determine if you are required to file. After that, we’ll present the available filing options.